Orient Technologies, a company that has been making waves in the tech industry, is all set to launch its Initial Public Offering (IPO) this week. As the anticipation builds, investors are eager to know what the Grey Market Premium (GMP) reveals about this much-awaited offering.

This blog will dive into the details of Orient Technologies, the significance of GMP, and what potential investors can expect as the IPO hits the market.

What is Orient Technologies?

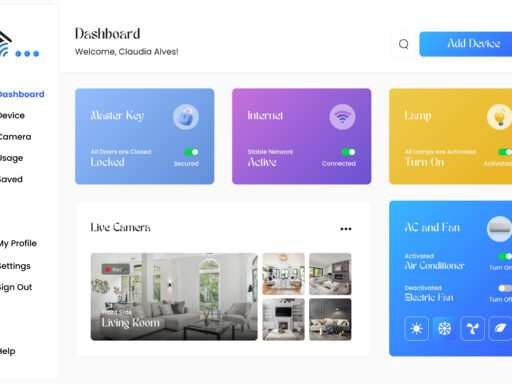

Orient Technologies is a leading player in the tech world, known for its innovative solutions and customer-centric approach. Founded a decade ago, the company has rapidly grown to become a household name in the technology sector.

Their product range includes advanced software solutions, cutting-edge hardware, and comprehensive IT services that cater to businesses of all sizes.

With a strong focus on research and development, Orient Technologies has consistently delivered products that not only meet but exceed customer expectations.

Their commitment to quality and innovation has earned them a loyal customer base and a solid reputation in the industry.

Understanding the IPO

An Initial Public Offering (IPO) is when a company offers its shares to the public for the first time. This allows the company to raise capital by selling ownership stakes to investors.

The funds raised through an IPO are typically used for various purposes, such as expanding operations, paying off debt, or investing in new projects.

For investors, an IPO represents an opportunity to own a piece of a company with the potential for future growth. However, it also comes with risks, as the value of the shares can fluctuate based on market conditions and the company’s performance.

The Importance of GMP

The Grey Market Premium (GMP) is an unofficial market where the shares of a company are traded before they are listed on the stock exchange.

The GMP provides an indication of how the market perceives the company’s value and the level of demand for its shares.

A high GMP suggests that there is strong interest in the IPO, and investors are willing to pay a premium to secure shares before they become available to the public.

Conversely, a low or negative GMP may indicate that there is less enthusiasm for the offering.

What Does the GMP Say About Orient Technologies?

As Orient Technologies prepares to go public, the GMP has been closely monitored by market analysts and potential investors. The current GMP indicates a positive outlook, with strong demand for the company’s shares.

This suggests that investors have confidence in Orient Technologies’ growth prospects and are eager to be a part of its journey.

However, it’s important to note that the GMP is just one of many factors to consider when evaluating an IPO.

Investors should also look at the company’s financial health, market position, and future growth potential before making a decision.

Why is Orient Technologies IPO Attracting Attention?

Several factors contribute to the buzz around Orient Technologies’ IPO:

- Strong Market Position: Orient Technologies has established itself as a leader in the tech industry, with a diverse range of products and services that cater to a broad customer base.

- Innovative Products: The company’s focus on innovation has resulted in the development of cutting-edge solutions that are in high demand.

- Growth Potential: With the funds raised through the IPO, Orient Technologies plans to expand its operations and invest in new projects, which could drive further growth.

- Positive GMP: The strong GMP suggests that there is significant interest in the IPO, which could translate into a successful offering.

How to Participate in the IPO

For those interested in participating in the Orient Technologies IPO, the process is relatively straightforward:

- Open a Demat Account: A Demat account is required to hold the shares electronically. If you don’t already have one, you’ll need to open an account with a registered depository participant.

- Select a Broker: Choose a broker through whom you will apply for the IPO. Many brokers offer online platforms that make the application process easy and convenient.

- Apply for Shares: Once you’ve selected a broker, you can apply for shares through the IPO. The application process typically involves specifying the number of shares you want to purchase and the price you’re willing to pay.

- Wait for Allotment: After the IPO closes, the shares will be allotted to investors based on demand. If the IPO is oversubscribed, you may receive fewer shares than you applied for.

- Start Trading: Once the shares are listed on the stock exchange, you can start trading them. Keep in mind that the share price may fluctuate based on market conditions.

Risks and Considerations

While the Orient Technologies IPO presents an exciting opportunity, you should be aware of the risks involved. Factors such as market conditions, the company’s performance, and broader economic trends can affect the value of the shares

Investors should also consider their own financial situation and investment goals before participating in the IPO. It’s always a good idea to consult with a financial advisor to ensure that the investment aligns with your overall strategy.

Conclusion

The Orient Technologies IPO is generating significant interest, thanks to the company’s strong market position, innovative products, and growth potential. The positive GMP indicates that there is strong demand for the shares, making it an attractive option for investors.

However, as with any investment, it’s important to do your research and carefully consider the risks before making a decision.

By understanding the company, the market, and your own financial situation, you can make an informed choice about whether to participate in the Orient Technologies IPO.

This blog provides a comprehensive overview of the Orient Technologies IPO, written in a simple and easy-to-understand manner. Whether you’re a seasoned investor or new to the world of IPOs, this guide offers valuable insights to help you navigate the process